How Nonprofits Raise Money in 2026 - Strategic Funding Guide

A Fully Detailed Fundraising Playbook for Nonprofit Leaders

Executive Summary

Fundraising in 2026 looks different than it did just a few years ago, but one reality remains: there is still significant funding available for nonprofits that deliver clear outcomes and operate with credibility and discipline. While language, priorities, and funding structures continue to evolve, funders across the public and private sectors are still investing heavily in proven solutions.

This guide is designed to help nonprofit leaders build repeatable, sustainable funding systems across multiple channels. It reflects how foundations, governments, schools, corporations, and donors are actually making decisions today — and what they expect from the organizations they choose to fund.

Inside, we break down how successful nonprofits are positioning their work, strengthening operations, and executing across diverse funding streams to unlock larger, longer-term opportunities.

What This Guide Covers

How funders really think and make decisions

The core funding channels nonprofits must master in 2026

How to execute across each channel

Why operations and data are fundraising multipliers

Introduction: What Changed and Why It Matters

Fundraising feels harder in 2026 because the “middle” is disappearing. In prior years, many nonprofits could survive on a combination of a few small grants, a handful of donors, and periodic community fundraising pushes. Today, funders have higher expectations, decision cycles are slower, and reporting requirements are tighter. That doesn’t mean the money is gone — it means the bar for trust and execution is higher.

At the same time, nonprofit leaders are navigating shifts in public language, especially around DEI. Many institutions are more cautious about how programs are framed and marketed. That caution has created confusion for nonprofit leaders who are committed to serving underserved communities but don’t want to be disqualified due to how they communicate. The key is to understand that the work can remain the same while the positioning becomes more outcomes-driven and institutionally “safe.”

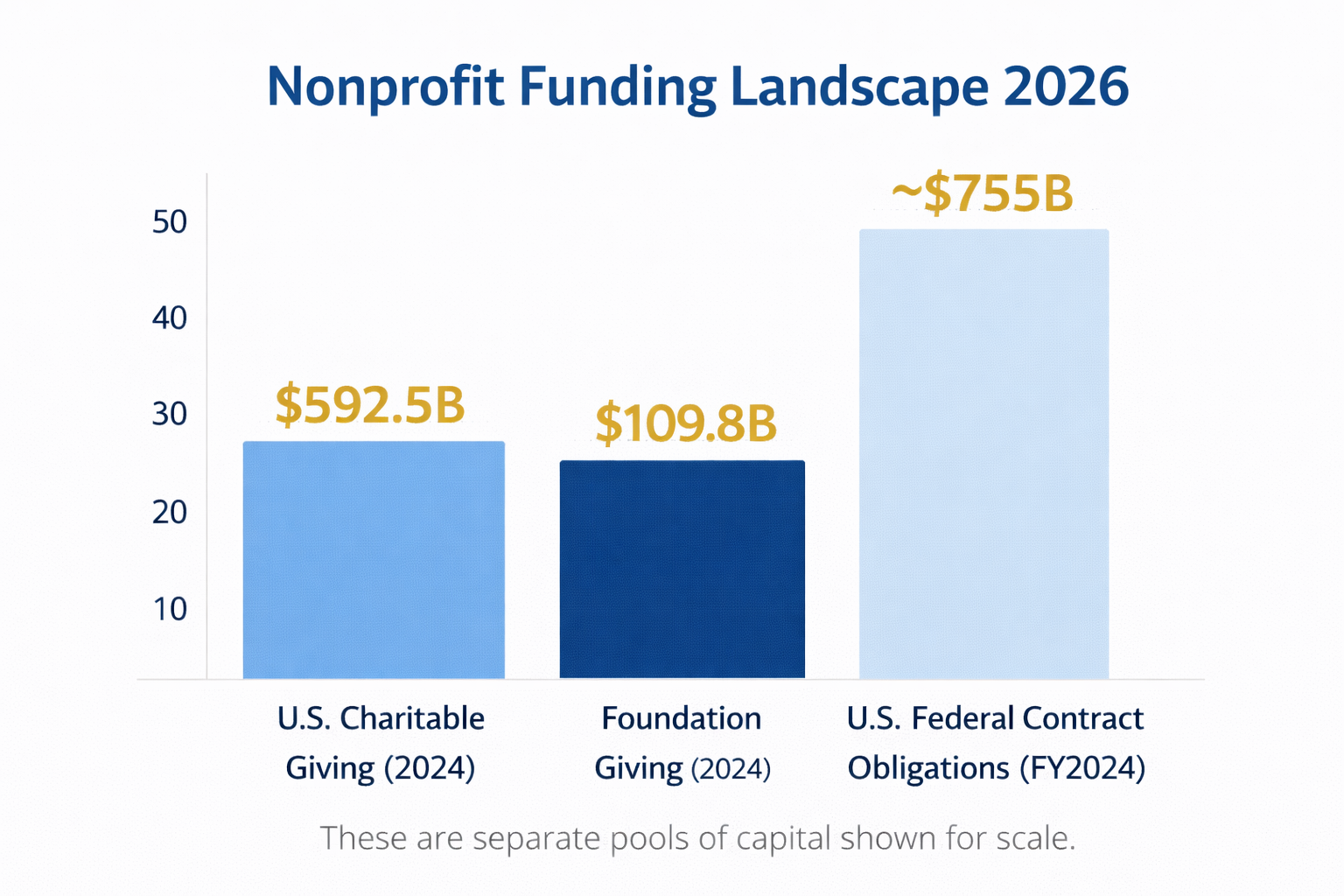

Funding opportunities still exceed hundreds of billions annually across public and private sources.

The most important truth to internalize is that the funding landscape is still enormous. U.S. charitable giving reached $592.5B in 2024. Giving USA+1 Foundation giving alone was $109.81B in 2024. NPTrust And governments continue to deploy massive budgets via vendors and service providers — the federal government committed about $755B on contracts in FY2024, and state and local spending totals in the trillions annually. Government Accountability Office+2Census+2

So if the money is still there, why do so many nonprofits feel stuck? Because funding is increasingly concentrated among organizations that operate like reliable partners — organizations that clearly define what they deliver, communicate outcomes with confidence, and run professional operations that reduce risk for the funder.

This guide is built to help nonprofit leaders move from “fundraising as survival” to fundraising as a structured system: multiple revenue channels, consistent communications, clear offerings, strong operations, and measurable outcomes. It is not meant to be motivational — it’s meant to be practical enough that you can turn sections into a real plan, delegate tasks, and execute.

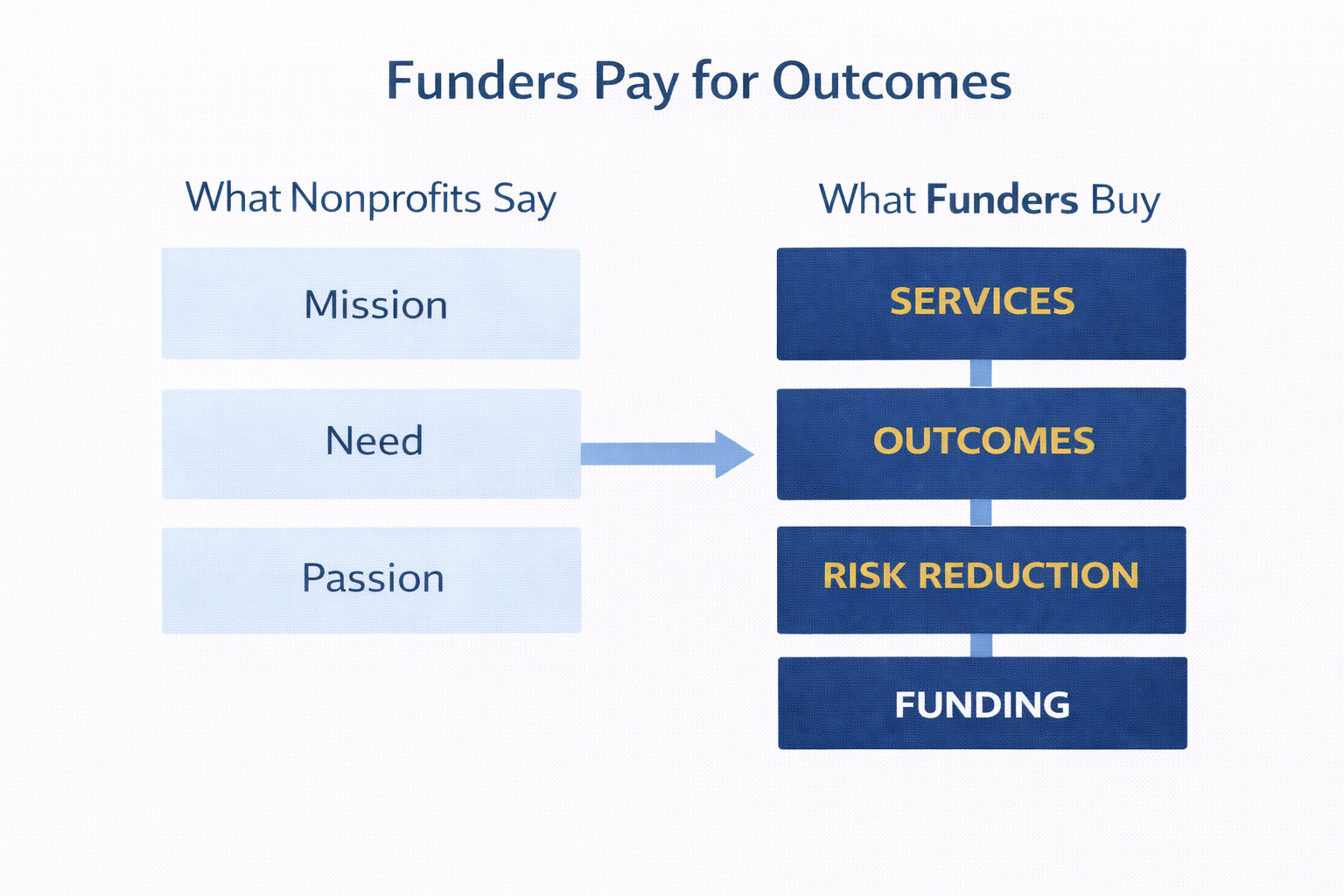

The Real Rule: Funders Pay for Outcomes (Not Charity)

Fundraising becomes easier when you stop thinking of funders as people who “give money” and start thinking of them as institutions trying to achieve goals under constraints. Even philanthropy is rarely charity in the casual sense. It is organized problem-solving, and the people making funding decisions are accountable to stakeholders, policies, timelines, and reputational risk.

Funders invest in outcomes, not intentions.

A government agency is accountable to taxpayers, elected leadership, auditors, oversight bodies, and budget offices. A foundation is accountable to its board, donor intent, and long-term strategic priorities. A corporation is accountable to executives, shareholders, brand leaders, and sometimes regulators. A school system is accountable to parents, principals, superintendents, boards, and student safety requirements. This accountability shapes everything: how they select partners, how they structure funding, what they require, and what they fear.

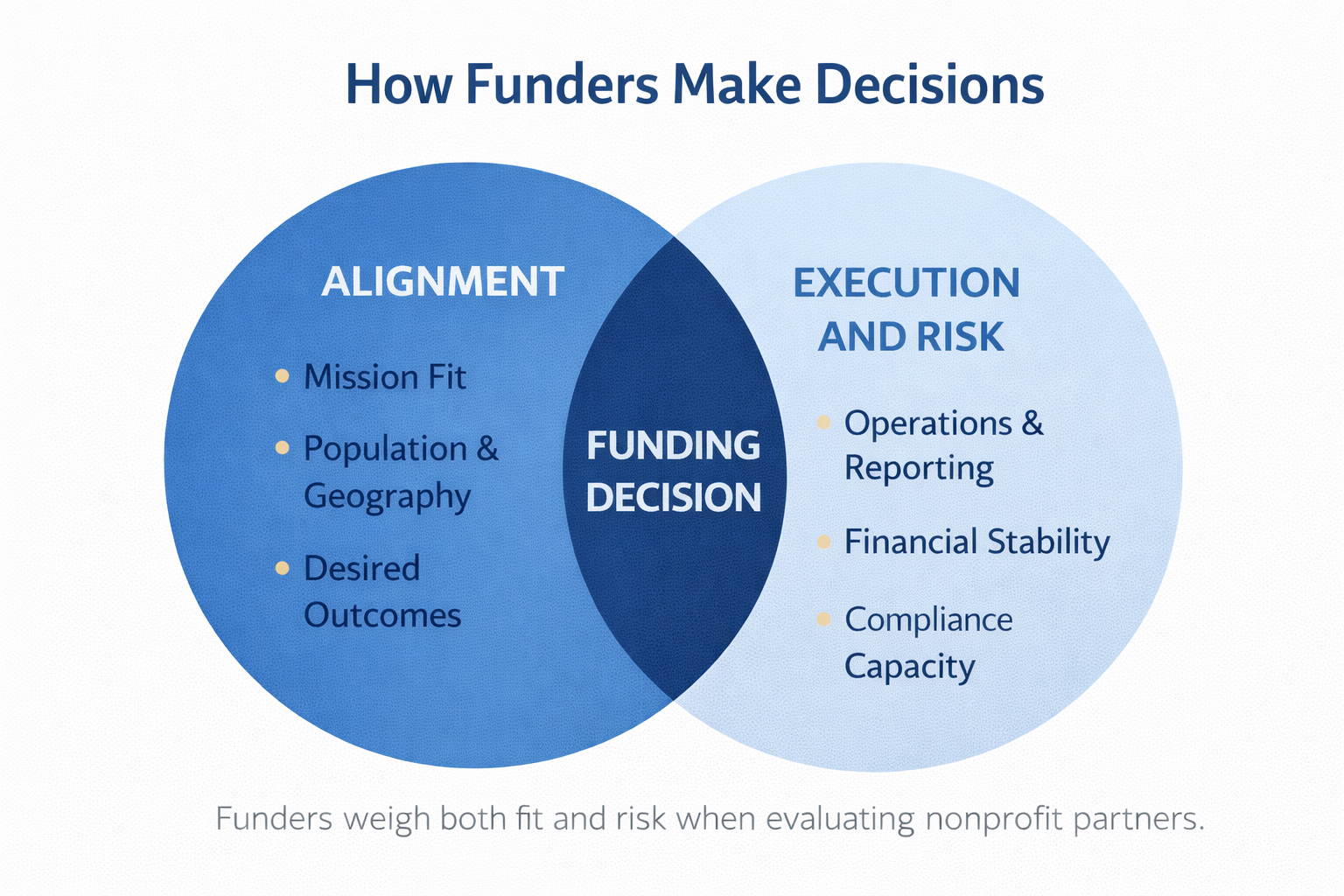

That means funders are making two decisions at the same time. First, alignment: does your work match what they exist to accomplish? Second, execution and risk: can you deliver without creating political, operational, financial, or reputational problems? Most nonprofits spend most of their energy proving alignment — storytelling, need statements, vision, and mission. But in 2026, the “risk” decision is often the dealbreaker.

This is why strong organizations win repeatedly. It isn’t only because they “write better grants.” It’s because funders can picture them delivering — on time, with quality, with documentation, with reporting that makes funders look good to their stakeholders. A foundation program officer needs to defend decisions to a board. A city agency needs to defend spending to oversight. A corporation needs to defend partnerships internally and externally. When you make those defenses easier through clean outcomes and professional operations, you become fundable.

That’s also why modern messaging matters. You may still serve underserved communities — and that work is still deeply needed — but your language should focus on the public value and measurable outcomes your work creates: employment, housing stability, academic improvement, mental health outcomes, reentry success, community safety, workforce readiness, public health improvements. You are not hiding the mission. You are translating it into the language institutions use to allocate capital.

The best way to operationalize this: treat every funding conversation as a question of what you deliver, who benefits, what changes, and how you prove it. If you can answer those clearly, you’ve already separated yourself from most organizations competing for the same dollars.

How Each Funder Thinks and Makes Decisions

Government Agencies (How government decides who to fund)

Every funding decision balances mission fit with delivery risk.

Government decision-makers operate in a world of oversight. Program managers and agency leaders must satisfy procurement rules, audit readiness, compliance expectations, and political scrutiny. They’re measured on service delivery volume, timelines, and outcomes. A failed program can trigger investigations, media attention, clawbacks, and reputational damage. That’s why “good mission” isn’t enough — they need partners who make delivery and reporting easier.

Government is also process-driven. Decisions often involve procurement offices, program teams, legal review, budget offices, and leadership approval. Even when a program manager loves your organization, there may be rules that require competitive bids, vendor registration, insurance thresholds, or documentation you can’t shortcut. That’s why readiness matters: the best organizations are “always ready” when opportunities open.

From a government lens, nonprofits are vendors delivering public services. They want: clear scope, clear deliverables, proof you can handle volume, and proof you can report accurately. If you become known as an organization that invoices correctly, tracks metrics properly, and doesn’t create administrative headaches, your odds of renewals and referrals rise dramatically.

Foundations (How foundations decide who to fund)

Foundations are mission-driven but structured. Program officers manage portfolios and must justify recommendations to committees and boards. They care about strategic alignment, credible leadership, evidence of impact, and reputation protection. They don’t want to fund organizations that seem unfocused, unstable, or unable to measure outcomes.

Foundations also think in “theories of change.” They’re not only funding activities; they’re funding pathways to outcomes. They want to know how your program connects to measurable change, and why your approach is credible. Many are also looking for leverage: scalable models, replicable programs, and insights that can influence systems beyond one site.

Schools and Districts (How schools decide who to buy from)

Schools want safety, simplicity, and quality. They have limited bandwidth and intense pressure from parents and boards. They avoid partners that create scheduling chaos, unclear deliverables, or compliance risk. They often choose vendors based on reliability and student experience as much as outcomes.

Schools also make decisions pragmatically. They ask: will this disrupt the school day? Will teachers complain? Will parents complain? Will the vendor show up prepared? Can we trust them around kids? If your program is operationally clean and your team is professional, schools will often rehire you before they experiment with someone new.

Corporations (How corporate partners decide to sponsor)

Corporations invest where it supports workforce goals, ESG reporting, community impact commitments, brand reputation, and employee engagement. They need measurable outcomes and “proof of impact” that can be used internally and externally. They often want events and activations because those produce visible community engagement — but they also demand professionalism because a poorly run event reflects on them.

Major Donors (How high-net-worth donors decide)

Major donors fund leadership as much as programs. They evaluate competence, credibility, and stewardship. They dislike pressure and react poorly to spam. They value transparency, respect, consistent updates, and evidence the organization executes. For many major donors, the deciding factor is confidence — they want to believe that your organization will turn dollars into impact efficiently.

Keep these lenses in mind as you read each channel — because “execution” changes depending on who you’re executing for.

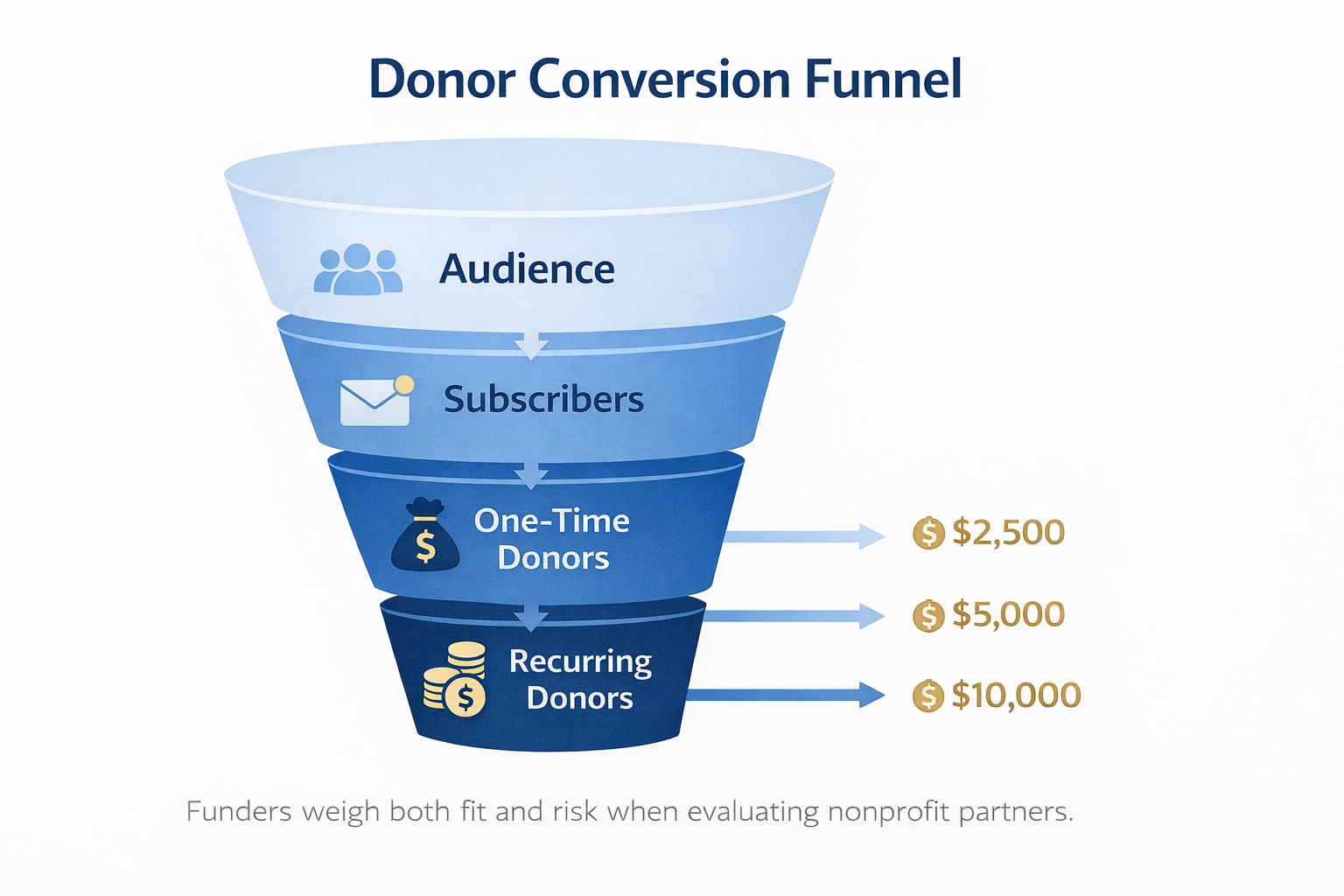

Community Giving and Crowdfunding (How to build recurring donors)

Recurring donors are built through trust and consistency.

Community giving is the broadest and most accessible funding channel. Most nonprofits already have a community — participants, parents, alumni, volunteers, supporters, social followers, newsletter subscribers. The issue is rarely “no audience.” The issue is that the audience isn’t being engaged consistently enough to become a reliable revenue base.

From the donor’s perspective, small donors aren’t performing deep due diligence. They are making a trust-based decision. They give when they understand what you do, feel emotionally connected, and see proof that your organization is active, real, and making progress. Their biggest fear isn’t fraud — it’s wasting money on an organization that feels disorganized or inactive.

That’s why crowdfunding fails when it’s treated like emergency fundraising. If supporters only hear from you when you need money, they experience pressure, not connection. What works in 2026 is building a rhythm of storytelling and updates that makes supporters feel like insiders — people who are seeing the mission unfold, not just being asked to pay for it.

To do this well, you need internal clarity first: what programs are you running right now, what services are being delivered, what outcomes are you tracking, and what stories can you honestly tell every month? Many nonprofits struggle with communication because they haven’t documented their work in plain language. Fix that, and content becomes easier, faster, and more consistent.

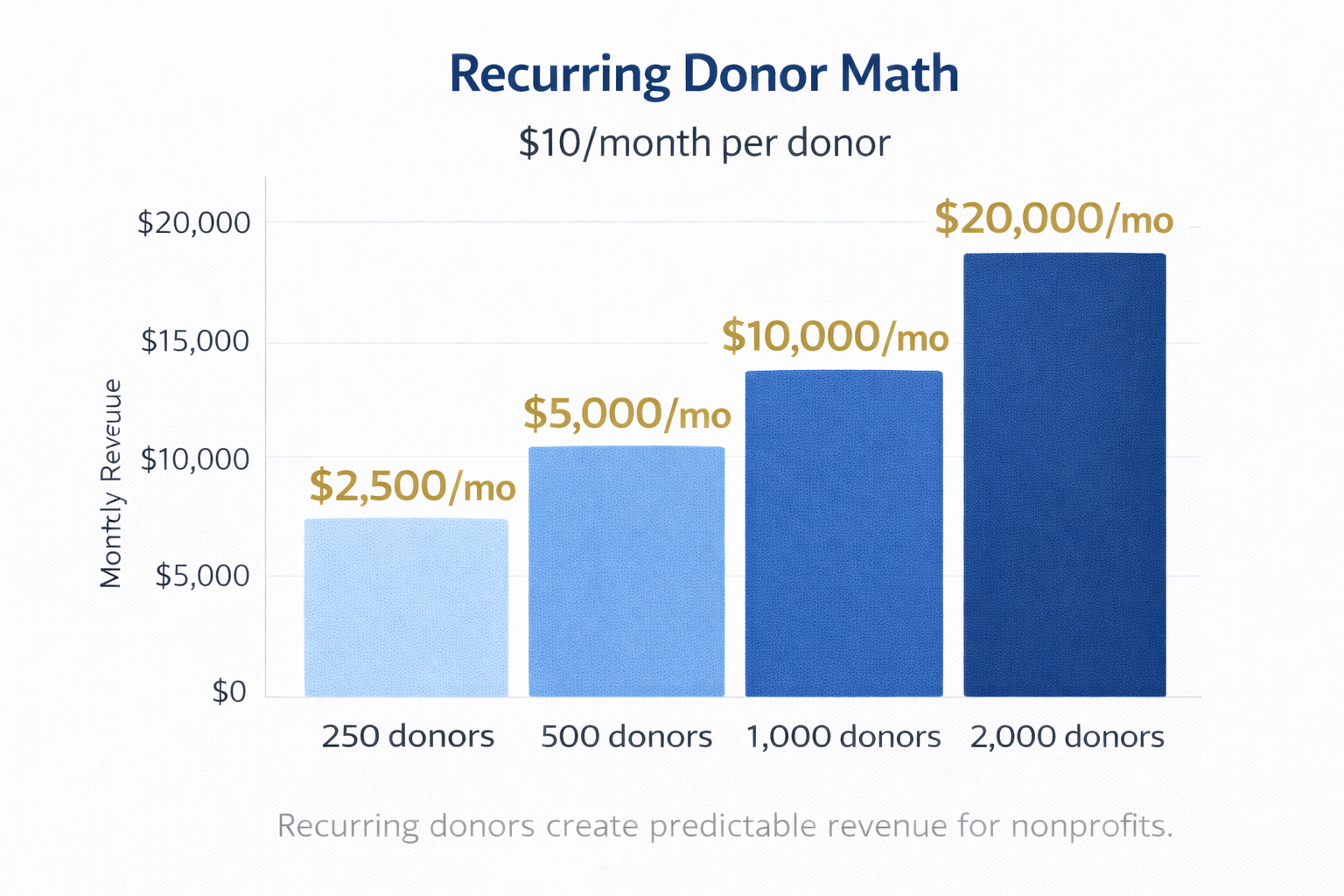

Small recurring gifts create predictable cash flow.

The strongest model for community giving is recurring donations. Recurring donors stabilize cash flow and reduce panic. The math becomes powerful quickly: 500 people giving $10/month is $5,000/month. 1,000 people giving $10/month is $10,000/month. The goal is not a viral fundraiser — it’s a steady base you can plan around.

How to begin executing (practical steps):

Create a simple “What We Do” one-pager (plain language, not grant language).

Build a monthly or quarterly update format:

what happened, who was served, what changed, what’s next.

Choose one recurring ask:

“Join our monthly supporters at $10/month.”

Use one primary donation link and make it frictionless.

Track:

email subscribers, open rates, donors, recurring donors, and churn.

What funders/partners are looking for here: consistency and credibility. A strong community giving engine becomes social proof that helps you win foundation grants, corporate partnerships, and even government opportunities because it signals real community trust.

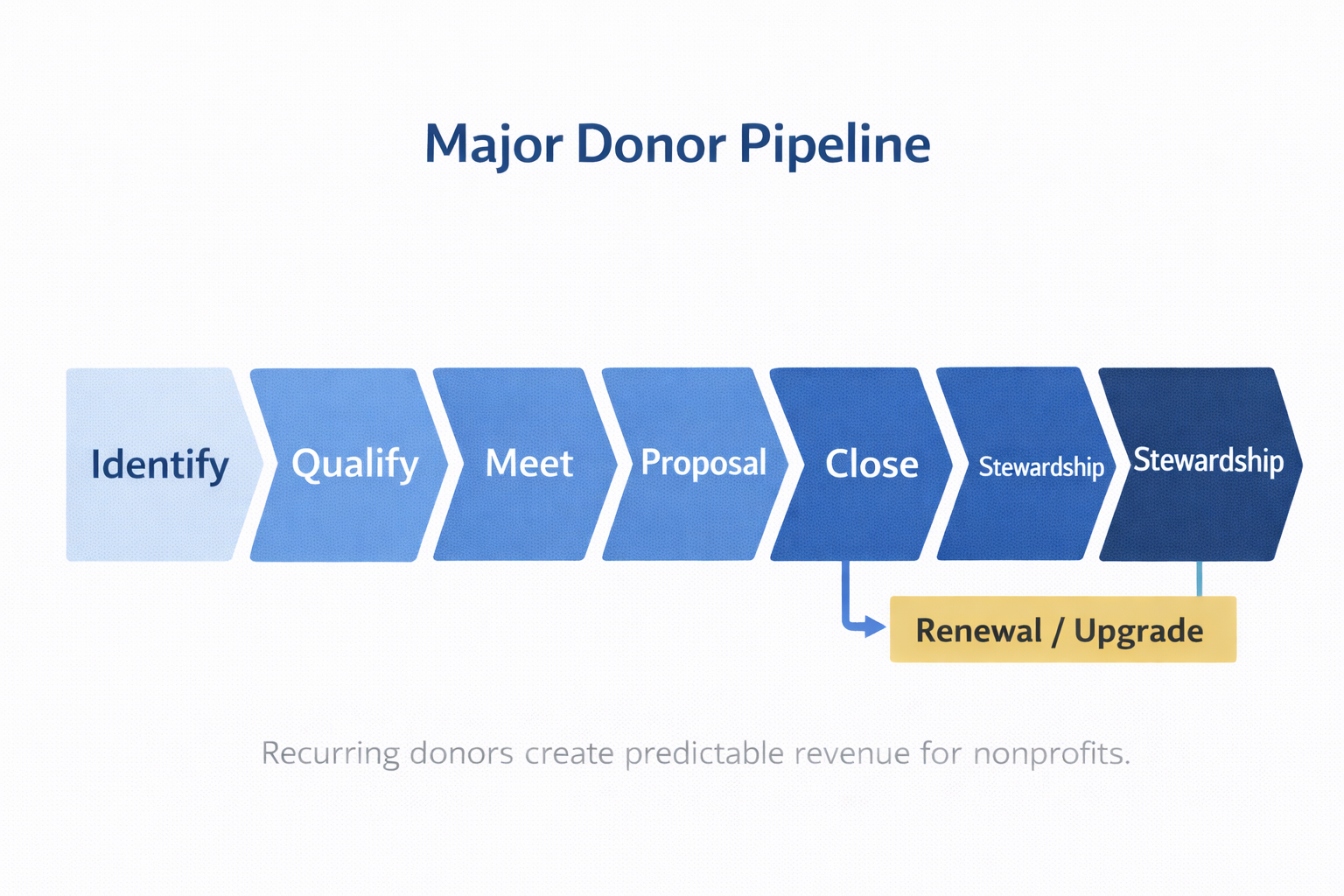

Major and Mid-Level Donors (How to build a donor network)

Major donors are a different world. The mindset is less transactional and more relational — but also more evaluative. Major donors are not “buying a cause.” They are choosing whether to trust a leader and an organization with meaningful resources. They are watching how you operate, how you communicate, and whether your organization feels stable and serious.

Major donors often make decisions based on confidence. They want to see that the organization has a clear plan, credible leadership, and the operational ability to execute without drama. Their biggest fear is funding chaos — an organization that is always behind, always scrambling, and unclear about where the money goes.

This channel works best when you stop thinking of it as “asking rich people for money” and start thinking of it as building a portfolio of relationships with people who can accelerate your mission. The posture changes. You’re not begging; you’re inviting them into a real strategy and a real plan.

Major donors fund leadership, clarity, and execution.

Execution begins with mapping your network and your “network of networks.” Many nonprofits underestimate who they know indirectly: board members’ colleagues, alumni, parents of participants, local business owners, professionals who support similar causes. Start with who is already close to your mission, then expand outward intentionally.

Then you need a major donor narrative. This is not your grant boilerplate. It’s a clean story that answers: what problem are we addressing, what do we deliver, what outcomes have we achieved, what is the plan for the next 12–24 months, and what would additional funding enable? Major donors want to fund momentum, not confusion.

Major donor fundraising also requires stewardship. People give more when they feel respected, informed, and included. They give less when they feel pressured or spammed. In 2026, “staying in touch” is often what determines whether major gifts renew and grow.

How to begin executing (practical steps):

Build a donor prospect list of 25–50 names (start small, grow over time).

Segment:

mid-level ($1k–$5k), major ($5k–$25k), top-tier ($25k+).

Create a “Major Donor Brief”:

mission, outcomes, plan, funding needs, budget highlights.

Start with 10 relationship meetings:

focus on learning and alignment, not an immediate ask.

Create a stewardship rhythm:

quarterly updates, invitations to activations, impact summaries.

What funders are looking for here: leadership maturity and follow-through. Major donors often become connectors to foundation introductions, corporate sponsorships, board recruitment, and high-value partnerships.

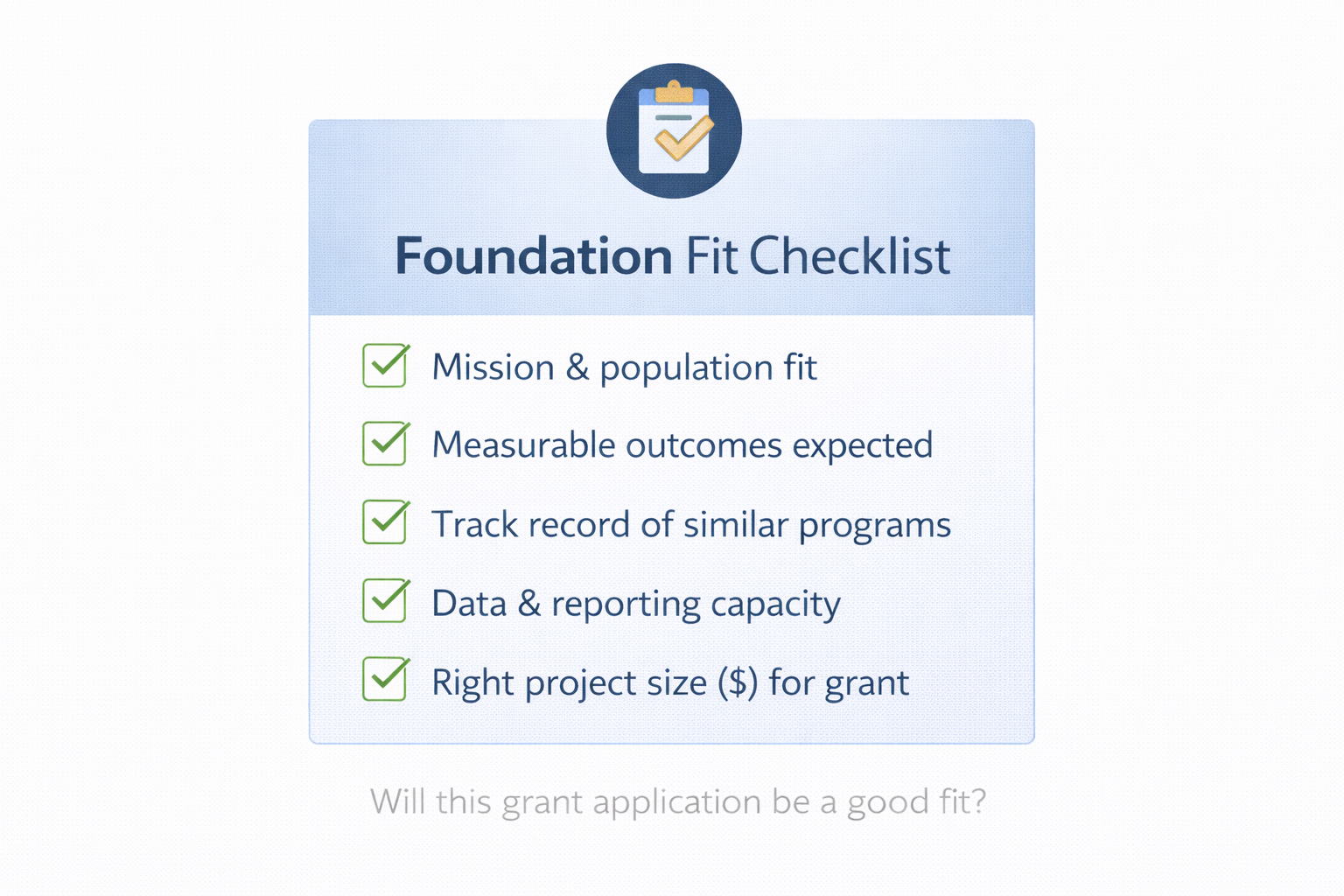

Foundations (How to win aligned foundation funding)

Foundations are not simply “grantmakers.” They are strategic institutions allocating capital to achieve outcomes aligned with their mission and board priorities. The biggest mistake nonprofits make is treating foundations like a lottery: applying broadly and hoping something hits. In 2026, that approach burns time and morale.

Strong alignment saves time and increases win rates.

From the foundation’s perspective, they are managing reputational risk and strategic fit. Program officers and committees are asking: does this organization align with our priorities, can it deliver measurable results, and will we be proud to be associated with this work? Foundations also care about portfolio logic — they don’t want 20 unrelated grants; they want a coherent strategy.

Foundations are also outcome buyers. They may care about systems change, community health, youth outcomes, education, poverty reduction, workforce mobility. But in all cases, they want clarity. They want to see how your program drives their desired outcomes and how you will measure it. If your outcomes are vague, your application feels risky.

This is why funder research matters. Great foundation fundraising starts before the application. You study the foundation’s focus areas, past grantees, geographic priorities, typical grant size, and what they actually fund (direct services, capacity building, advocacy, research, etc.). You do not want to spend 30 hours on a proposal that never had fit.

Execution then becomes about making the “alignment case” easy. The best proposals are not long. They are clear: need, solution, outcomes, measurement, capacity, budget. Clarity is your competitive advantage.

How to begin executing (practical steps):

Build a list of 30 foundations:

10 perfect fit, 10 good fit, 10 stretch fit.

For each, document:

focus area, geography, typical awards, application process, past grantees.

Create a reusable “Foundation Narrative Library”:

core program description, outcomes, data points, budget template.

Use letters of intent whenever possible to test fit early.

After any rejection, request feedback and refine alignment.

What foundations are looking for: strategic fit + evidence + credibility. The strongest advantage you can build is clean outcomes reporting and strong operations, because foundations are allergic to chaos.

Government Contracts (How nonprofits win service contracts)

Government contracts are one of the largest pools of funding in the country — and one of the most misunderstood. Governments often fund nonprofits not because they love the mission, but because they need someone to deliver services that the public sector cannot efficiently deliver alone. Federal contracting alone was about $755B in FY2024, illustrating the scale of procurement funding overall. Government Accountability Office

From the government’s perspective, contracting is a risk-managed process. They must follow procurement rules, document fairness, ensure compliance, and be audit-ready. Program managers are under pressure to deliver results and spend budgets correctly. A vendor that fails creates political and operational headaches, and can trigger audits or public scrutiny.

That’s why government contracting rewards organizations that operate like disciplined service providers. Reliability beats charisma. Compliance beats storytelling. Clean invoicing beats emotional narratives. When you do government work well, the payoff is stability — renewals, referrals, multi-year relationships, and a track record that unlocks larger opportunities.

Government funding rewards preparedness and compliance.

The biggest barrier is readiness. Many nonprofits discover contracts and apply immediately, but they haven’t registered as a vendor, organized required documents, built reporting systems, or planned cash flow for reimbursement-based payments. That’s where many fail — not because their mission is weak, but because they can’t operationalize delivery and compliance fast enough.

Execution begins with positioning your nonprofit as a “vendor” with clear offerings. Governments are buying services. Your job is to clearly define your service package, delivery model, capacity, and measurable outcomes, and to present it in a format procurement teams recognize.

How to begin executing (practical steps):

Register as a vendor (city/county/state portals).

Build a compliance folder:

501(c)(3), Form 990, bylaws, insurance, W-9, SAM (if relevant), key policies.

Identify procurement portals and subscribe to solicitations.

Build a “Capabilities Statement”:

services, outcomes, experience, staffing, certifications.

Create a cash flow plan:

if reimbursement takes 60–120 days, how will you front costs?

What government funders expect: compliance, delivery, reporting, and low risk. If you deliver on time and report cleanly, you become the kind of partner agencies fight to keep.

School and Education Contracts (How to sell services to schools)

Schools value safety, simplicity, reliability, and outcomes.

School contracting can be a powerful revenue channel, especially for nonprofits delivering academic enrichment, mental health supports, arts programming, STEM, workforce exposure, or family engagement. Many nonprofits miss this channel because they approach schools only as partners — not as institutions that pay vendors for services.

From the school’s perspective, they are accountable to parents, boards, and state requirements. They are also time-constrained. They do not want complicated partners. They want vendors that are safe, predictable, easy to coordinate with, and capable of delivering high-quality student experiences without creating additional burdens for staff.

Schools also care about outcomes — but their outcomes are specific. They care about attendance, engagement, student wellbeing, academic improvement, and behavior support. Your job is to map your program outcomes to the school’s world in a way that principals and administrators can defend to parents and leadership.

The decision process often involves principals, program coordinators, procurement offices, and sometimes district administrators. That means your program must be easy to approve: clear scope, clear pricing, clear schedule, clear safety/compliance readiness. If you can reduce friction, you increase the likelihood of being adopted and renewed.

Execution begins with a clean service offering: what you deliver, for how long, what it costs, what outcomes to expect, and what logistics are required. Schools do not want ambiguity. They want confidence.

How to begin executing (practical steps):

Identify 20 target schools/districts aligned with your work.

Understand vendor approval requirements (insurance, background checks, vendor portals).

Create a “School Program One-Pager”:

scope, schedule, outcomes, staffing, safety.

Offer a pilot option with clear success metrics.

Build references:

testimonials, photos (with consent), teacher feedback, outcome summaries.

What schools expect: safety, simplicity, reliability, and positive student experience — plus outcomes they can defend.

Corporate and Institutional Partnerships (How to win sponsors)

Corporate funding in 2026 is often strategic, not charitable. Companies invest in nonprofits to support workforce goals, ESG reporting, community impact mandates, employee engagement, and brand reputation. This is why corporate partnerships often feel more structured and deliverable-driven than foundation grants.

Corporate funding is driven by outcomes, brand safety, and reporting.

From the corporate perspective, they need measurable impact and a clean story they can tell internally and externally. They are brand-sensitive and risk-aware. They do not want messy programs, unclear execution, controversies, or partners who can’t deliver reliably.

This channel rewards nonprofits that can speak the language of outcomes and deliverables. Corporations want to know: what will happen, who will be reached, what will change, and what proof will we get? The more you can answer that clearly — without fluff — the more credible you appear.

Corporate decisions can also be layered — CSR teams, marketing, HR, executives, and legal may all have input. That’s why clarity and professionalism matter. You need a clean proposal, a clear budget, and a strong plan for reporting results. If a corporate partner cannot easily explain your partnership internally, they often won’t move forward.

Execution begins with research: what companies are in your region, what are their priorities, what initiatives do they fund, and how do you align? Then you approach them with a low-friction offer that’s easy to say yes to (pilot, event sponsorship, cohort underwriting) and easy to report on.

How to begin executing (practical steps):

Build a list of 25 corporate targets (local + national with local footprint).

Identify CSR/ESG priorities and any workforce/community initiatives.

Create a partnership menu:

sponsorship, program underwriting, activations, employee volunteer days.

Build a reporting template:

attendance, sign-ups, outcomes, testimonials, photos.

Start with a low-friction offer:

sponsor an activation, fund a pilot, or underwrite a cohort.

What corporates expect: measurable impact, brand-safe execution, reliable coordination, and reporting they can reuse.

Activations: Turning Community Events Into Sponsorship Revenue

Activations are one of the most powerful (and overlooked) ways for nonprofits to generate revenue while serving the community. A strong activation is not “just an event.” It’s a platform for funders to accomplish goals: enroll residents, distribute resources, demonstrate community impact, collect sign-ups, and show public-facing engagement.

Activations turn community trust into sponsor value.

Government agencies, healthcare systems, utilities, banks, colleges, and corporate partners all struggle with distribution. They have services and resources, but they need trusted access to communities. If your nonprofit can convene real people at scale — in-person or virtual — you become the bridge. That bridge is valuable, and sponsors will pay for it.

From the sponsor’s perspective, they’re paying for reach and outcomes. They want to know: how many people will attend, what actions will happen (enrollments, sign-ups, screenings), what data will be captured, and what proof they will receive afterward. Sponsors often need post-event metrics for internal reporting, community impact commitments, or public communications.

This approach becomes profitable when you treat activations like a product with deliverables. You are not selling logos. You are selling impact and distribution. That means sponsorship packages should be built around outcomes: number of attendees reached, number of sign-ups captured, number of services delivered, number of follow-ups generated.

Execution starts by making activations repeatable. One-off events are good. Repeatable formats are better: quarterly resource fairs, monthly workshops, annual expos, recurring virtual enrollment sessions. Repeatability turns “events” into a predictable revenue stream.

How to begin executing (practical steps):

Identify 1–3 activation formats you can repeat (quarterly or monthly).

Build a simple event KPI dashboard:

attendance, demographics, sign-ups, referrals, services delivered.

Create sponsorship tiers tied to deliverables:

tables, speaking slots, data capture, follow-up campaign, co-branding.

Package post-event reporting:

partner report, photos, testimonials, metrics summary.

Build a sponsor pipeline:

target agencies and companies with engagement mandates.

What sponsors expect: credible turnout, professional execution, clean reporting, and proof they can share.

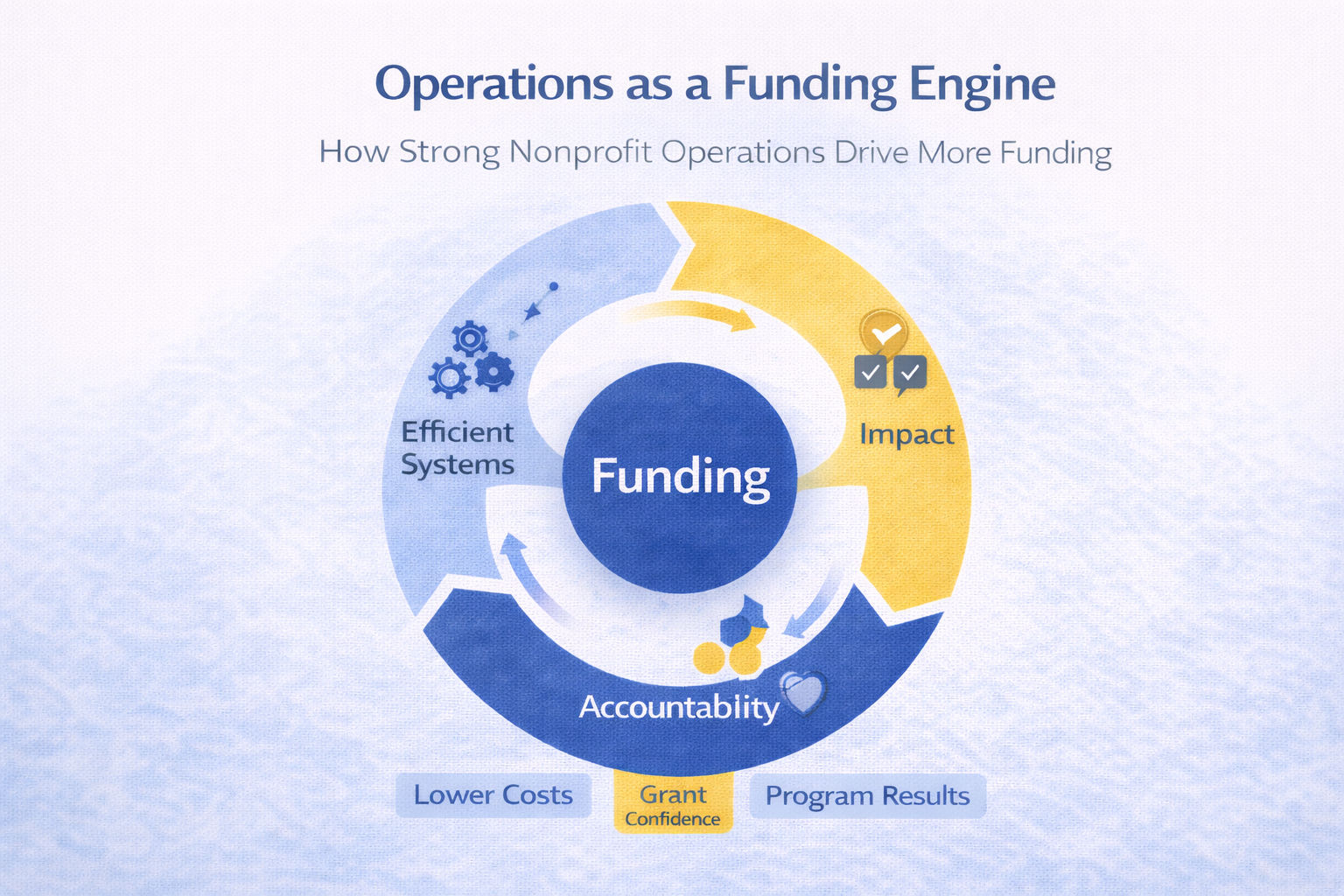

Operations: The Hidden Fundraising Multiplier

The most underrated truth in fundraising is that operations often decide who gets funded. Funders don’t just fund missions — they fund organizations that can deliver without chaos. In 2026, operational maturity is a competitive advantage, and in many competitions it’s the deciding factor.

Operations are a hidden driver of fundraising success.

From a funder’s perspective, poor operations equal risk. If your team misses deadlines, loses documents, can’t produce reports, can’t track outcomes, or can’t invoice correctly, you create problems for the funder. That makes renewals less likely and referrals almost impossible.

Strong operations make everything easier: grant writing improves because you have real data; donor engagement improves because you can share structured updates; government contracting improves because you can comply; activations improve because you can coordinate partners; corporate sponsorship improves because you can report cleanly.

Operational excellence doesn’t mean “big budget.” It means clarity: clear roles, documented processes, centralized files, consistent reporting, and disciplined follow-up. Many small nonprofits can outperform larger ones simply by being organized.

How to begin executing (practical steps):

Centralize documents (one drive, consistent folder structure).

Create simple SOPs for:

intake, service delivery, attendance tracking, reporting, invoicing.

Assign owners for:

fundraising, reporting, partner communication, compliance.

Build a weekly cadence:

team check-in, deliverables review, reporting updates.

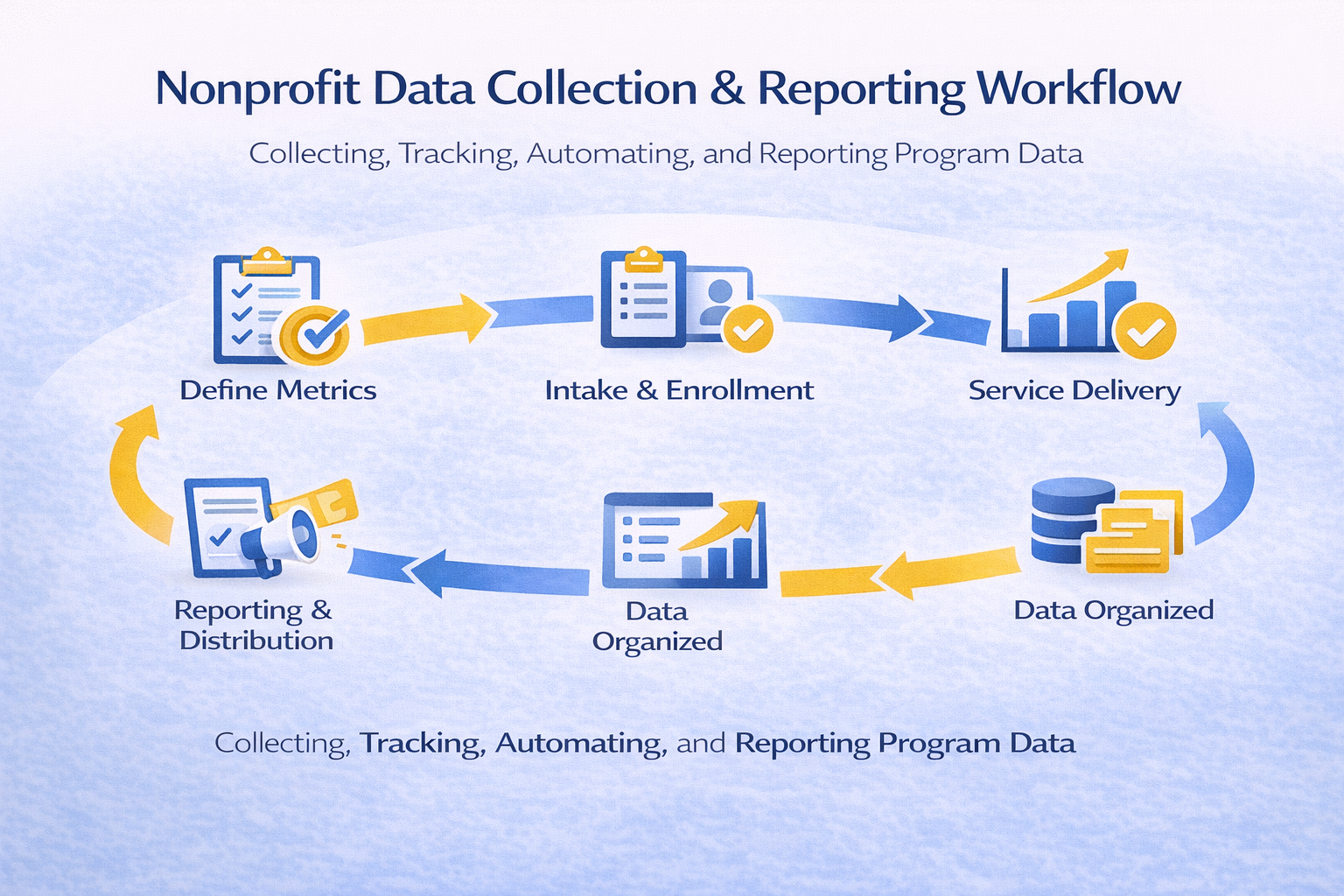

Data, Reporting, and Credibility (How to prove impact)

Data is not optional in 2026. It’s the language funders use to justify decisions. It doesn’t need to be complicated, but it must be consistent. Funders don’t require perfection — they require confidence that you are measuring something real and managing programs intentionally.

Data is the language funders use to renew and scale funding.

Funders want proof that services were delivered and outcomes were achieved. Schools want evidence of student engagement or improvement. Governments want required metrics. Foundations want outcome stories backed by numbers. Corporations want impact data for ESG and communications.

Start small: choose 3–5 key metrics that matter. Track them consistently. Report them clearly. Over time, those metrics become your credibility engine — and they make your proposals easier to write because you’re no longer guessing.

Your reporting should also be reusable. A strong quarterly impact report can be repurposed for donors, foundations, sponsors, and partners. That saves time and creates consistency in your messaging across every channel.

How to begin executing (practical steps):

Choose core metrics:

number served, completion rates, pre/post measures, referrals, placements.

Create lightweight tracking tools:

forms, spreadsheets, simple CRM, attendance logs.

Produce a quarterly impact update:

narrative + metrics + testimonials + photos (with consent).

How Startup Advisory Group Supports Nonprofits

Startup Advisory Group helps nonprofit leaders move beyond reactive fundraising and build sustainable, outcome-driven funding systems. We work with organizations that understand funding is tied to credibility, operations, and measurable results — not just mission statements or one-time grant submissions.

Advisory support for nonprofits focused on outcomes, operations, and sustainable growth.

Our team supports nonprofits across community giving, major donors, foundations, government and school contracting, corporate partnerships, and community activations. We help clarify service offerings, strengthen funder-facing narratives, build fundraising pipelines, and implement repeatable systems that scale without overwhelming internal teams.

We also focus heavily on operational readiness — organizing documentation, improving reporting and compliance, and building workflows that increase renewal rates and long-term funding stability.

If your organization wants a clear fundraising strategy and hands-on execution support, learn more about our Fundraising & Grant Management services or schedule an introductory conversation with our team:

👉 https://www.startupadvisorygroup.co/fundraising-grant-management

Final Takeaways

The funding is still there — but the standards have changed. The nonprofits that win in 2026 will be the ones that understand how funders think, operate professionally, deliver measurable outcomes, and build repeatable funding systems instead of chasing one-off wins.

This guide is not about “raising money fast.” It’s about building a model that makes fundraising predictable, credible, and sustainable.

If you build strong operations, consistent communications, measurable outcomes, and multiple funding channels, you stop depending on luck — and start building long-term stability.

FAQ Section

How do nonprofits raise money besides grants?

Nonprofits raise money through recurring donors, major gifts, corporate sponsorships, government and school contracts, events/activations, and partnerships that pay for service delivery.

How do I create a nonprofit fundraising plan?

A strong fundraising plan includes revenue goals by channel, a donor communication schedule, a grant pipeline, vendor registrations for contracts, a sponsor list, and quarterly impact reporting.

Are government contracts worth it for nonprofits?

Yes, if the nonprofit is operationally ready. Government contracts can be stable and renewable, but require compliance, reporting, and cash-flow planning.

What do foundations look for in nonprofit grant applications?

Foundations look for alignment, credible leadership, measurable outcomes, strong execution capacity, and low reputational risk.